PH BIR 1904 2024-2026 free printable template

Show details

(To be filled out by BIR) DAN: ___Republic of the Philippines Department of Finance Bureau of Internal Revenue BIR Form No. Application for Registration1904January 2024 (ENDS) P1 0 0 0 0 0For Onetime

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 1904 bir form

Edit your bir 1904 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 1904 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

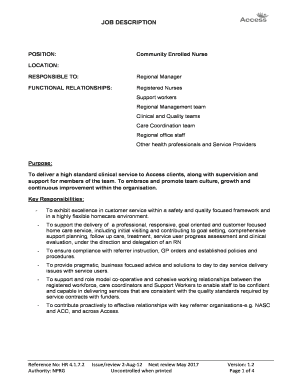

Editing bir form 1904 download online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bir 1904 form download. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1904 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out bir 1904 form

How to fill out PH BIR 1904

01

Obtain the PH BIR Form 1904 from the BIR website or a local BIR office.

02

Fill out the basic information such as the taxpayer's name, address, and TIN (Tax Identification Number).

03

Indicate the type of registration under the relevant section (e.g., self-employed, etc.).

04

Provide details of the business or profession, including the nature of the business and the date of commencement.

05

Fill in the information about the taxpayer's authorized representative, if applicable.

06

Check the appropriate box for the type of tax (e.g., income tax, percentage tax).

07

Sign the form and date it at the bottom.

08

Submit the completed form to the designated BIR office.

Who needs PH BIR 1904?

01

Individuals or entities who are registering for a new business or profession in the Philippines.

02

Self-employed individuals who need to comply with local tax regulations.

03

Businesses that are required to obtain a tax identification number and register with the BIR.

Fill

bir form 1904 pdf

: Try Risk Free

What is bir form 1904?

BIR Form No. 1904. Download. (PDF 2018 ENCS) | (PDF 2000 ENCS) Application for Registration For One-Time Taxpayer and Persons Registering under E.O. 98 (Securing a TIN to be able to transact with any Government Office)

People Also Ask about form 1904 bir

What is the purpose of TIN in the Philippines?

The purpose of the TIN is for proper taxpayer identification, and is required on all forms used for filing returns such as income tax returns, VAT returns, percentage tax return and the like. Statements and documents pertaining to the BIR will also indicate the TIN.

What is the TIN number in the Philippines?

Every taxpayer in the Philippines is given a special, permanent number called a Tax Identification Number (TIN). It is used for tax purposes and other transactions with the Bureau of Internal Revenue (BIR) and other government agencies.

What is Form 1904 in the Philippines?

› Document to support transaction between a non-resident foreign corporation and the withholding agent(e.g. bank certification, invoice, contract, etc.). Accomplish BIR Form 1904 and submit the same together with the documentary requirements to the RDO having jurisdiction over the residence of the applicant.

What is EO 98 Philippines?

Pursuant to EO 98, series of 1998, persons whether natural or juridical, dealing with all government agencies and instrumentalities, including Government-Owned and/ -or Controlled Corporations (GOCCs), and all Local Government Units (LGUs), are thereby required to incorporate their TIN in all forms, permits, licenses,

Why do you need the BIR Form 1904?

What is 1904 BIR Form Purpose? This form is the application form for those who want to register as a one-time taxpayer and those registering under E.O 98. This form is also the application for those who wish to secure a TIN to be able to transact with any government office.

What is the difference between 1902 and 1904?

1902 is for registration of Individuals Earning Purely Compensation Income - Local and Alien Employees; and BIR Form No. 1904 is for registration of One-Time Taxpayers and Persons Registering under E.O. 98.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 1904 bir form download from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including bir form 1904 online registration, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out bir form no 1904 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign 1904 form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out bir form on an Android device?

Use the pdfFiller Android app to finish your bir form 1904 editable and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is PH BIR 1904?

PH BIR 1904 is a tax form used in the Philippines for the registration of individuals earning income from business and/or practice of profession, specifically for those without any business permit.

Who is required to file PH BIR 1904?

Individuals who are self-employed, including professionals earning income from their service, need to file PH BIR 1904 if they do not have a business permit.

How to fill out PH BIR 1904?

To fill out PH BIR 1904, you need to provide your personal details, including your name, address, and Tax Identification Number (TIN), along with details of your income and the nature of your business or profession.

What is the purpose of PH BIR 1904?

The purpose of PH BIR 1904 is to register self-employed individuals for tax purposes and to facilitate the tax collection process by the Bureau of Internal Revenue (BIR) in the Philippines.

What information must be reported on PH BIR 1904?

The information that must be reported on PH BIR 1904 includes the individual's name, address, TIN, nature of business or profession, and details of income earned during the period.

Fill out your PH BIR 1904 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Form 1904 is not the form you're looking for?Search for another form here.

Keywords relevant to download bir form 1904

Related to form 1904 bir pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.